If you don’t know what to expect, purchasing a home can be intimidating. That’s why we put together this resource for new homebuyers – so you can prepare yourself for the process.

The homebuying process is full of steps and terms that might not be familiar to you. This mini glossary defines those terms to help you navigate the process more easily.

Amortization: When the principal you owe for your mortgage reduces over time with every payment you make.

Appraisal: When a third party evaluates a property to determine the true value of the home. In many cases, an appraisal is required by a mortgage lender, will be scheduled by the lender, and the cost will be included in the closing costs (if not waived).

Annual Percentage Rate (APR): How much it will cost annually in order to pay off the loan. Unlike the interest rate, an APR takes into account any applicable loan fees/charges.

Closing: When the buyer, seller, lender, and company all sign off on the paperwork to finalize the sale of the home and the execution of the loan.

Closing Costs: Money the seller and borrower must pay up front at closing, including down payment, fees, taxes, etc.

Co-signer: The person who will be on the mortgage loan with you. We need all the same items for a co-signer as we do for you (proof of income, social security number, proof of assets, etc).

Contingency: Specific criteria established in the purchase agreement that must be met for the sale to continue (often based on home inspection and loan approval).

Debt-to-Income Ratio (DTI): It is expressed as a percentage and is calculated by adding up all your monthly debt payments (housing, loans, and credit cards) and dividing it by your monthly income (pre-tax).

Earnest Money: Money given to the seller upon making an offer to show the potential buyer’s interest in the home; if the buyer ends up closing on the home, the amount given as earnest money is removed from the final sale amount.

Escrow: A monthly payment that includes applicable insurance and property taxes. Not all loan programs include escrow, so some programs may leave you responsible to pay the insurance and taxes. For loan programs that do include escrow, the amount is added to the principal and interest to make up your monthly loan payment.

Fair Market Value: The value given to a home based on its specifications/locations compared to similar properties in the area.

Interest Rate: A percentage of the loan which is charged as a fee to the buyer in exchange for receiving the loan. Unlike APR (see above), it does not include any other fees or charges.

Loan-to-Value (LTV): A percentage that expresses how the amount of the loan compares to the value of the property.

Private Mortgage Insurance (PMI): Insurance that may be required when an LTV is greater than 80%.

Points: Fees paid to the lender at closing in exchange for a reduced interest rate; 1 point costs 1% of the mortgage amount.

Preapproval: A lender runs a credit report and considers assets, liabilities, and income to determine if the borrower(s) is/are qualified for a home loan.

Principal: The amount of funds which are being borrowed to purchase the home; this excludes any fees, charges, or interest.

Rate Lock: A guarantee of what the interest rate will be; this rate cannot change unless closing occurs after the rate lock expiration date.

Refinance: When a borrower already has a home loan but “reapplies” for a new loan to replace it. Common reasons to do this include: interest rates have decreased, you want a shorter loan term, or you want to borrow against your home based on the equity you already have in it.

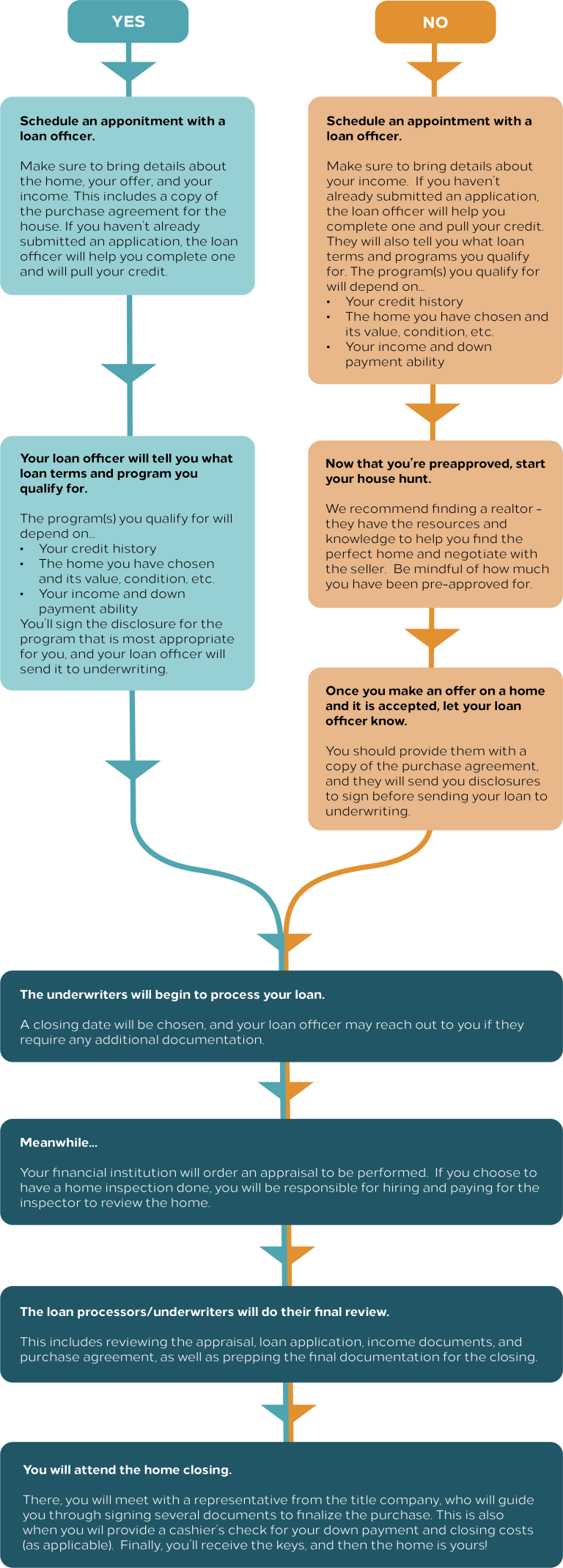

Follow the flowchart below for an idea of what steps you’ll go through to purchase a home.

First: Have you already found and made an offer on a property?